Your hospital will give you a Parent Pack which includes the forms you need including a Newborn Child Declaration. 9am - 8pm Sat.

Should You Buy A Life Insurance On Your Children Maybe Maybe Not

Should You Buy A Life Insurance On Your Children Maybe Maybe Not

You choose a life insurance.

Baby life insurance. Each policy has a guaranteed cash value and every year a tax-free dividend is paid into this cash value. Yes this sounds scary but its the truth. Cash value in a whole life policy is like a behind-the-scenes savings account.

By and large on account of death the policyholder during the approach term a pre-concurred sum total guaranteed is paid to the candidate. There is also the option of getting term life insurance for children. Yes life insurance would cover funeral expenses but the likelihood of actually needing it is so slim that youre better off putting the monthly premium payments into a savings account.

Most families can easily afford a life insurance policy on the life of a baby or child. Basically in the policy there will be cash value that accrues over time. Term life insurance increases by 45-9 on average every year that you put off getting it.

Most healthy younger parents will buy term life insurance as its generally more affordable than permanent life insurance. The reality is that many policies can be purchased for less than 9 per month so any expenses are minimal. Life insurance is to compensate for the loss of a breadwinner not a baby.

1 Life Insurance is Protection for Newborn Babies No one can predict the future. Thats when you add your children to your own life insurance. These policies have existed since 1847 and a dividend payment has never.

Newborn baby health insurance on the off chance that you become sick. Baby life insurance is an added expense for a family. Baby Daddy Insurance POB 4069 New Orleans LA 70178.

By having these rates locked in your baby will be protected from rate increases that will inevitably happen as they get older or as their health begins to worsen over time. Life insurance is an approach to give your family the chosen people budgetary help in the event of the guaranteeds inconvenient death. Sometimes with these policies you can also add critical illness cover to the policy.

Life insurance pays money to a beneficiary a spouse or co-parent for example when the insured person dies. And because you are focused in this case on a set period of time when your children will need financial support say their first 18-22 years purchasing insurance with an expiration date might make sense for your family. By adding on ECI and CI coverage with the whole life insurance policy for your child you are able to protect your child in any case of critical illness till age 99 but by paying for a limited number of years.

Adorable Babies HD Images. We understand you want to give your child every advantage. For as little as 1 a week you can give your child a lifetime of life insurance protection with plans starting at 5000.

Once your baby is born you have to register the birth with the Department of Births Deaths and Marriages in your state. That said a baby life insurance policy can be used to help save money for college or any other future expense. A health insurance arrangement repays the guaranteed for restorative and careful costs emerging from an ailment or damage that prompts hospitalization.

One of the reasons that many parents consider getting life insurance for a newborn baby is that they have a unique opportunity to lock in the lowest monthly rates on the market. It offers financial protection by providing 5000 to 50000 of whole life insurance coverage while also building cash value over time to help provide a nest egg for the future. Baby boomers those born between 1946 and 1964 will generally pay more for life insurance because theyre getting the policy at an older age.

You have 60 days to register the birth in NSW VIC SA TAS WA and NT and six months to do so in ACT 2. The Gerber Life Grow-Up Plan is a childrens whole life insurance policy that can provide lifelong insurance protection for your child or grandchild as long as premiums are paid. Then you retain control of that money and can use it for other reasons like if your child needs their tonsils taken out.

The Million Dollar Baby Plan Invest in your childs future. For families without a few extra dollars to spend a month life insurance may not be an additional bill they are able to pay. The Million Dollar Baby Plan is an asset class of life insurance called participating whole life insurance.

Happiest Baby will receive a referral fee if you choose to apply for Haven Term life insurance. Household finance experts recommend buying enough life insurance to see. The most common kind of life insurance for children is known as rider insurance.

Obviously we all want to never even think about the horrible things that can come from life. The Grow-Up Plan is a simple budget-minded way to start for children ages 14 days to 14 years.

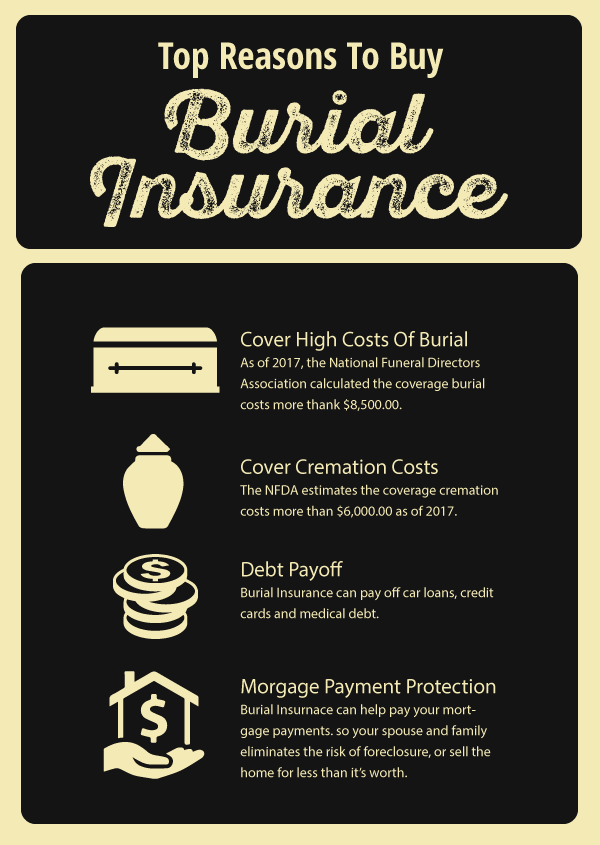

Is Burial Insurance Right For You Forbes Advisor

Is Burial Insurance Right For You Forbes Advisor