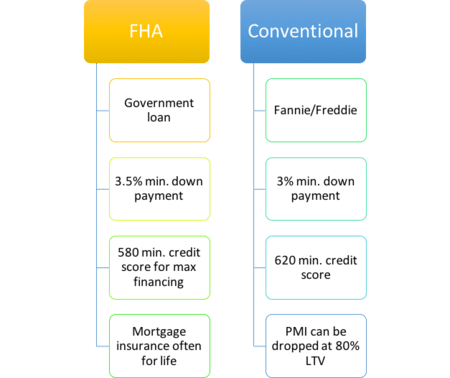

A conventional loan is a type of mortgage that is not part of a specific government program such as Federal Housing Administration FHA Department of Agriculture USDA or the Department of Veterans Affairs VA loan programs. When going for these types of loans for investment properties a commercial.

What Is A Conventional Loan 2021 Rates And Requirements

What Is A Conventional Loan 2021 Rates And Requirements

Banks and Credit unions also make portfolio loan products that are referred to as conventional.

Types of conventional loans. There are also two types of conventional loans. Adjustable-Rate Conventional Loans This is an alternative to fixed-rate mortgage as these loans offer an ARM or adjustable-rate mortgage. Fixed or Adjustable Rate are available.

Here are six different forms of conventional financing. Conventional loans come in a variety of types including fixed-rate and adjustable-rate. A conventional loan is a type of mortgage that is not part of a specific government program such as Federal Housing Administration FHA Department of Agriculture USDA or the Department of Veterans Affairs VA loan programs.

It is typically a fixed term at a set rate and conforms to the loan. With a fixed-rate conventional loan the interest rate you pay remains the same for the entire life of the loan. However conventional loans are commonly interchangeable with conforming loans since they are required to conform to Fannie Mae and Freddie Macs underwriting requirements and loan.

Conventional loans come in a variety of options with several advantages for qualified borrowers. Types of conventional loans Fixed-rate conventional loans. A conforming loan is actually one of the two types of conventional loans.

There are different types of commercial investment property loans each with specific terms and qualifications that make them suitable for certain types of commercial properties. This is a good option if you plan to be in the home for a significant period of time and if interest rates are low. In order to compete with government loans such as FHA loans there are a number of conventional loan programs designed for first-time homebuyers or anyone that does not have the funds for a large down payment.

Mortgage insurance required if the. Conventional Loans can come in fixed rates adjustable rates or hybrids all with their own unique value proposition. The conventional loan linked with an adjustable-rate is also called hybrid ARM which has a rate that might go down or up over time.

Conforming conventional loans follow the lending standards set. That means your monthly payments will stay the same too. A conventional loan is a mortgage that is not guaranteed or insured by any government agency including the Federal Housing Administration FHA the Farmers Home Administration FmHA and the Department of Veterans Affairs VA.

However conventional loans are commonly interchangeable with conforming loans since they are required to conform to Fannie Mae and Freddie Macs underwriting. A conforming conventional loan is a home mortgage for low-to-mid value homes. Conventional Loans are mortgage loans that are guaranteed by the Federal Home Loan Mortgage Corporation Freddie Mac andor the Federal National Mortgage Association Fannie Mae.

For example commercial hard money loans are short-term loans to purchase and renovate an owner-occupied commercial property. 6 types of conventional loans There are several types of conventional loans including conforming and non-conforming loans. With mortgage interest rates as low.

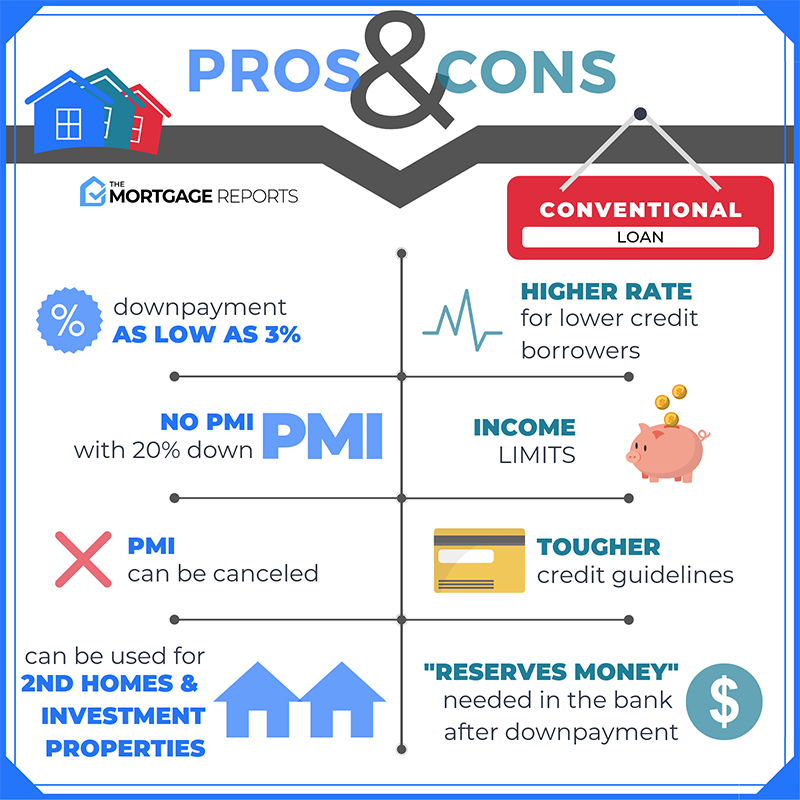

Down payment between 3-20. If you do qualify though conventional loans can offer more flexibility in the form of low interest rates lower fees and a larger variety of loan programs. Wells Fargo for example has several options to choose from for conforming conventional loans like 30 years fixed rate 20 years fixed rate 15 years fixed rate 71 ARM 51 ARM that all offer APR rates of as little as 5.

Conventional loans can be divided into two categoriesconforming and non-conforming loans. They also have varying terms with the most popular conventional loans having a lifespan of either 30 years. Fixed-Rate Conventional Loans A fixed-rate conventional loan will have an interest rate that will not change over the life of the loan.