The Betterment platform allows users to invest in portfolios of passive index-tracking equity and fixed-income ETFs. No Betterment does not offer custodial accounts.

Betterment Review 2021 The Best Robo Advisor One Shot Finance

Betterment Review 2021 The Best Robo Advisor One Shot Finance

This means that as long as the first withdrawal occurs after age 59 ½ the.

Betterment custodial account. A Roth Individual Retirement Account is a tax-advantaged market incorporated retirement vehicle that is distinctive from 401ks and Traditional IRAs in that it is funded with after-tax dollars and both grows and is withdrawn tax-free. If you are a parent or guardian of a young person this gives you the opportunity to save and invest for your child while retaining full control of the account until they reach adulthood. Checking made available through Betterment Financial LLC.

And Betterment is one of the only robo-advisors that provides an automatic tax-loss harvesting feature to all accounts regardless of balance. You can set up a custodial account in the same way you would a standard brokerage investing and trading account letting you buy and sell stocks ETFs mutual funds options bonds and more. However ETRADE Core Portfolios does offer Uniform Gifts to Minors Act UGMA and Uniform Transfer to Minors Act UTMA accounts while Betterment doesnt support custodial accounts.

Betterment does not offer custodial accounts UTMAUGMA. The fee structure includes account management fees based on account balance and what are called expense ratio fees fees assessed based on additional expenses associated with investments in a given portfolio. Checking accounts and the Betterment Visa Debit Card provided by and issued by nbkc bank Overland Park Kansas Member FDIC.

The average expense ratio fee is 013 percent according to various sources. Unlike the previous two options Betterment is more accustomed to larger account sizes. Betterment customer support is available seven days a week.

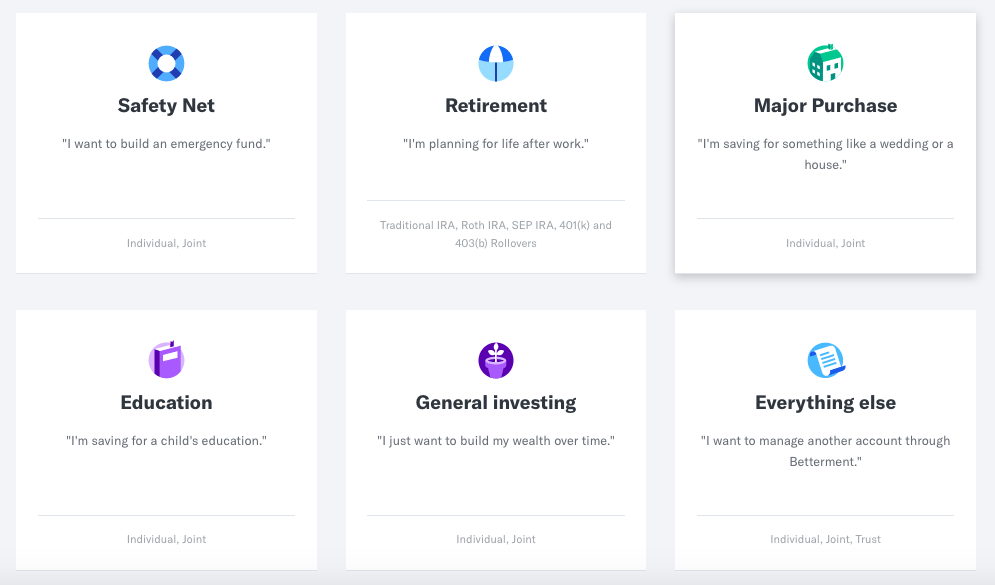

Betterment will even help you figure out which assets are best to donate. Betterment offers a set of expert-built portfolios in which you can invest comprised of low-cost ETFs. Betterment is a robo-advisor that allows automated and goal-inspired investments for everyday individuals.

There are no account fees whatsoever. Any financial decisions made about the account. As an alternative we suggest a brokerage firm called TD Ameritrade that offers UTMAUGMA custodial accounts as well as 0 commission on stocks ETFs and other investment classes.

They do not allow self-directed investing and thus do not offer individual stocks and ETFs. Acorns investors have access to investment accounts IRAs custodial accounts and checking accounts. Customers with account balances of at least 100000 can opt in to the Betterment Premium tier of service for unlimited talks with Betterments financial advisors.

This kind of account provides you with maximum flexibility in how you choose to. Betterment gives users access to tax advantaged savings accounts such as traditional and Roth IRAs. Custodial Accounts with Betterment.

Betterment does not have Custodial accounts. However you can create separate savings goals for minors using the platform and then make a withdrawal on their behalf. Neither Betterment LLC nor Betterment Financial.

Brokerage services provided to clients of Betterment LLC by Betterment Securities an SEC-registered broker-dealer and member of FINRA SIPC. Does Betterment have custodial accounts. Betterment Checking made available through Betterment Financial LLC.

This is considered advantaged because the investment gains created by the IRA in the markets is not taxed. Cash Reserve is only available to clients of Betterment LLC which is not a bank and cash transfers to program banks are conducted through the clients brokerage accounts at Betterment Securities. If you have a trust set up for your children Betterment does offer a trust account that you should look into.

Features unique to Acorns Round-Ups. The entire structure that Betterment uses to invest your funds is based on MPT or Modern Portfolio Theory. With Stash their expert portfolios are simply ETFs.

Betterment offers a couple more account options than Stash namely Joint and Trust. But Stash offers a Custodial account that Betterment doesnt have. All Betterment accounts qualify for tax-loss harvesting to help you lower your tax bill but you do have to enable it when you set up your account.

You can also open an ETRADE retirement account for children under 18 with earned income and benefit from tax-deferred potential earnings. Neither Betterment Financial LLC nor any of their affiliates is a bank. You cannot select your own funds.

Betterment Investment Products. If youre account is below 100000 you pay a 025 fee each year and if your balance is above 100000 you pay a 040 fee but have access to features not included with the basic account option. Betterment Cash Reserve and Betterment.

Betterment also lets you donate shares to charities and if you do that with appreciating assets you can avoid some capital gains taxes. Betterment also offers a. Its important to note too that Betterment does not offer any type of self-directed investment account.

A custodial account is a savings account that an adult manages for a minor or a person under the age of either 18 or 21 depending on the state. A custodial account is a financial account held in the name of a minor usually by a parent legal guardian or another relative. Investors can automate their savings goals by rounding purchases up to the nearest dollar and investing the difference.

Checking accounts and the Betterment Visa Debit Card provided and issued by nbkc bank Member FDIC.