The Internet EIN application is the preferred method for customers to apply for and obtain an EIN. You are limited to one EIN per responsible party per day.

How To Apply For A Federal Tax Id Number

How To Apply For A Federal Tax Id Number

Please ensure that support for session cookies is enabled in your browser.

Apply for fein. The other three options will not be as speedy as going through the online application process but it is still three other ways you can go to get to the federal employer identification number. Applying is a simple process usually done online. To apply for an FEIN over fax you fill out a paper application and fax it to the government.

The person applying online must have a valid Taxpayer Identification Number SSN ITIN EIN. This number is issued by the IRS and is required if you will have employees. We help you file and obtain your tax ID number for you business.

Many businesses need to apply for permits and licenses in order to operate such as alcohol or food-related licenses or construction-related permits. If you are required to have a FEIN there are several ways you can apply for one. Again you need to make sure the government has all your required business details.

It is also mandatory for your UIA registration. See How to Apply for an EIN. Remember a FEIN is provided free by the IRS.

Third parties can receive an EIN on a clients behalf by completing the Third Party Designee section and obtaining the clients signature on Form SS-4. If playback doesnt begin shortly try restarting your device. However you will need Adobe.

See Requirements for more information on how to enable your browsers session cookies. Its also worth remembering that applying for a tax ID number is free. If youve been asked to pay to apply.

Number for further details. A FEIN is also required for sole proprietorships that file for bankruptcy or form a partnership. In some circumstances this number is required for opening a business bank account.

Sole proprietors for instance must apply for a FEIN only if they file any excise or pension tax plan returns hire employees or form a limited liability company. In order to use this application your browser must be configured to accept session cookies. Applying for a federal identification number is one of many tasks that partners must take on when starting a business partnership.

In most cases youll have your EIN the same day you apply. How To Apply For An EIN Number - Tax ID - FEIN. To apply for a FEIN Federal Employer Identification Number you must go to the IRS website and follow the free registration process to get your ID number.

Applying for permits and licenses. You may also apply by telephone if your organization was formed outside the US. You can apply for a FEIN number by phone mail as well as fax.

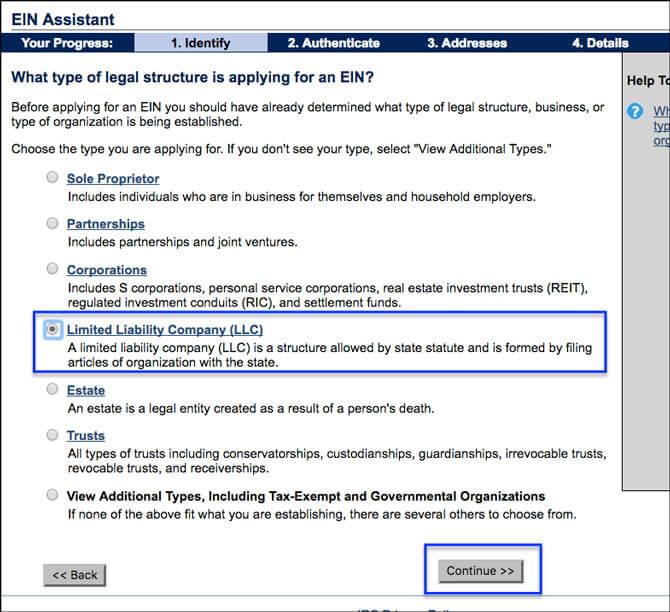

While its usually desirable to apply for a Federal EIN online there are other ways. An employer ID number is used by the IRS to label and tax your business. Once the application is completed the information is validated during the online session and an EIN is issued immediately.

As mentioned business credit is often established through the use of an FEIN. Apply for Federal EIN FEIN Number. 800 829-4933 By fax or mail.

You should have a current Internet browser which will allow you to view and complete the application process. For fastest results make sure to include your return fax number with your application. You can submit your application by calling and speaking to a representative on the phone mailing an application or faxing an application.

Even if you dont need a FEIN its worth getting. The phone application process is the second quickest behind applying online. If you prefer to apply via fax mail or telephone you can do this too.

The online application process is available for all entities whose principal business office or agency or legal residence in the case of an individual is located in the United States or US. Applying for a FEIN is quick and easily done online by mail or by fax. When you apply over the phone you are talking to the Internal Revenue.

Permits and licenses are generally identified through the use of an FEIN and without an FEIN a business wont be able to apply for them. This task allows you to obtain a Federal Employer ID Number FEIN also sometimes known as an EIN for your business and enter it into the One Stop system. We apologize for any inconvenience this may cause you.

Then you should receive your number within four business days. You can apply for an EIN on-line by mail or by fax. A FEIN or EIN is also known as an employer identification number and many businesses need to use one.

International applicants may apply by phone. See the instructions PDF for Form SS-4 Application for Employer ID. To apply for an employer identification number you should obtain Form SS-4 PDF and its Instructions PDF.

How to apply for a federal tax ID FEIN number. You may apply for an EIN online if your principal business is located in the United States or US. Apply for a Tax ID Number by Phone Mail or Fax.

You can apply for an EIN online by fax by mail. After receiving your application the government can mail or fax you an FEIN. You can find Form SS-4 here and locate the fax number and mailing.

You can go to IRSgov through any computer that has Internet access. Dont apply on any website that charges a fee for the ID go directly to the. To lessen the load of things that you or your partner have to do let IRS-EIN-TAX-ID file your FEIN paperwork for you.

Do I need a certain computer or software to obtain an EIN over the Internet. If you do not have an FEIN contact the IRS Business.