There are cards you can apply for that dont require SSNs. How to apply for a credit card without an SSN.

How To Get A Credit Card Without A Ssn Or Itin Self

How To Get A Credit Card Without A Ssn Or Itin Self

Credit history by applying for a secured credit card.

Ssn credit card. You can then use this form of identification to apply for an Employer Identification Number. Its a unique identifier lenders use to assess your creditworthiness. The government uses this number to keep track of each persons earnings and years of work.

This guide takes a look at the credit card options available to customers who dont have an SSN. To apply for a business credit card without using a Social Security number you need another form of identification as a substitute. Its also exactly what a would-be thief needs to apply for a credit card mortgage car loan or job in your name.

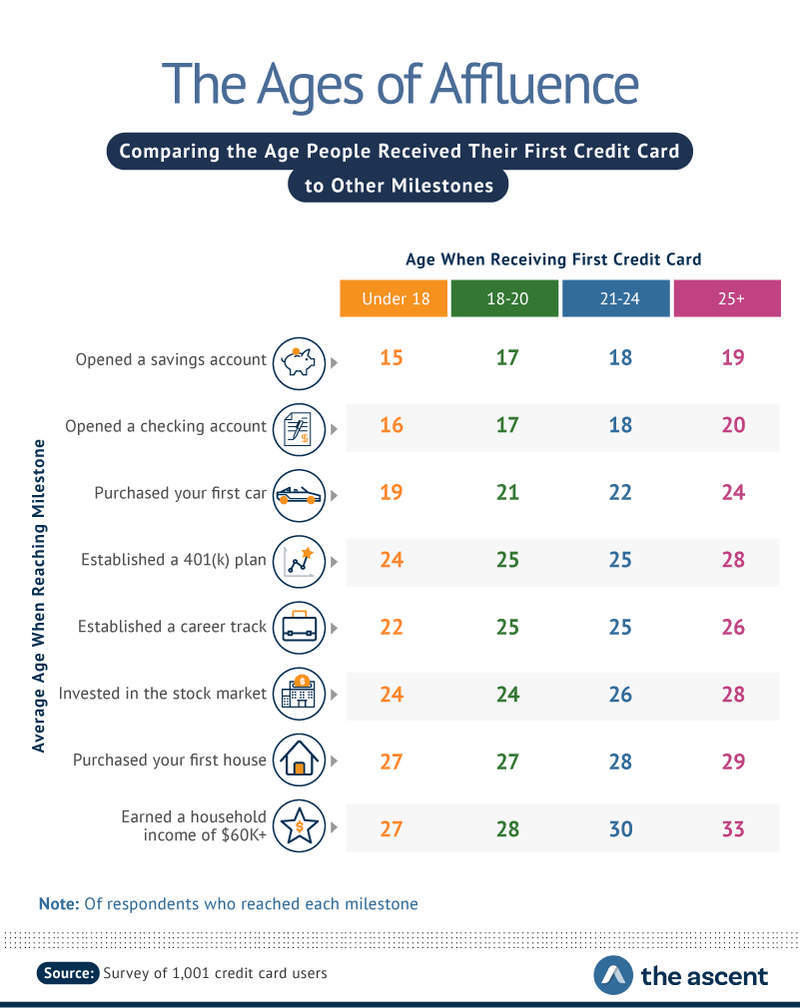

If youve attempted to apply for a credit card youve probably noticed most applications require a Social Security number SSN. Getting simple things like a credit card a loan or an apartment can become complicated without a Social Security Number SSN a nine-digit number that is only assigned to US. But if your citizenship status does not allow that then you may be able to apply for an Individual Taxpayer Identification Number ITIN.

With your SSN substitute and your EIN you can then apply for a business credit card. Seven of the 10 largest credit card companies in 2021 will approve applicants for a credit card without an SSN. The card is serviced by Comerica Bank which is based in Dallas Texas.

Your Social Security number is one of the keys to your financial health. Our service will help you find ssn and dob only knowing the name usa database lookup by address and state. But if you dont have an SSN acquiring a card might feel near-impossible.

However the good news is that there are some cards which are available with alternative forms of identification such as an ITIN Individual Taxpayers Identification Number. Social security numbers are a standard field on credit card applications which can give the impression that theyre required for approval. Not having an SSN can limit your ability to get a credit cardand your ability to spend easily and take advantage of consumer protection featuresbut its not a total roadblock.

This number is given to US citizens permanent or working residents with the primary purpose of tracking individuals for taxation enabling them to legally live work or study in the country. All you need to do is log in to or create your personal my Social Security account. Residents and citizens by the US.

If you have a Social Security number but a thin credit file you may need to start building your US. But dont give up. Nearly all of todays best small business credit cards require a SSNbut once your business is large enough to apply for corporate credit cards you.

Getting a replacement Social Security number SSN card has never been easier. We also use it to monitor your record once you start getting benefits. With these cards you provide a deposit.

As long as youre only requesting a replacement card and no other changes you can use our free online services from anywhere. Its called the Social Security Direct Express card and its a prepaid debit card that allows you to access and use your Social Security benefits. Many credit card providers require your SSN to process an application.

If youre like most Americans its also something you give out all too frequently. Shop search all peoples Usa robocheck online cc store. It is possible to open a credit card without an SSN.

Fortunately not all cards require a social security. Obviously the best option is to apply for a Social Security card. It helps us identify and accurately record your covered wages or self-employment earnings.

But its hard not to say that you cant as long as you put a little effort into it theres still a chance to apply for a US credit card. Credit cards without SSN requirements are cards that will accept a tax ID or passport instead of a Social Security number. Without a Canadian resident of SSN Social Security Number or ITIN it is difficult to apply for a credit card in the United States.

An ITIN is a tax-processing ID number that the IRS can use to track your earnings and tax. Social Security Number and Card Subscribe Your nine-digit Social Security number is your first and continuous connection with Social Security. One of the most common obstacles on the way to building a good credit history abroad is put in by the newcomers Social Security Number or SSN.

/how-opening-a-new-credit-card-affects-your-credit-score-96050-final-5b60bade46e0fb0025b3bc98.png)