Small Business Tax Deductions For 2019. If you pay someone to care for a child or another dependent while you work you may.

The Big List Of Small Business Tax Deductions 2021 Bench Accounting

The Big List Of Small Business Tax Deductions 2021 Bench Accounting

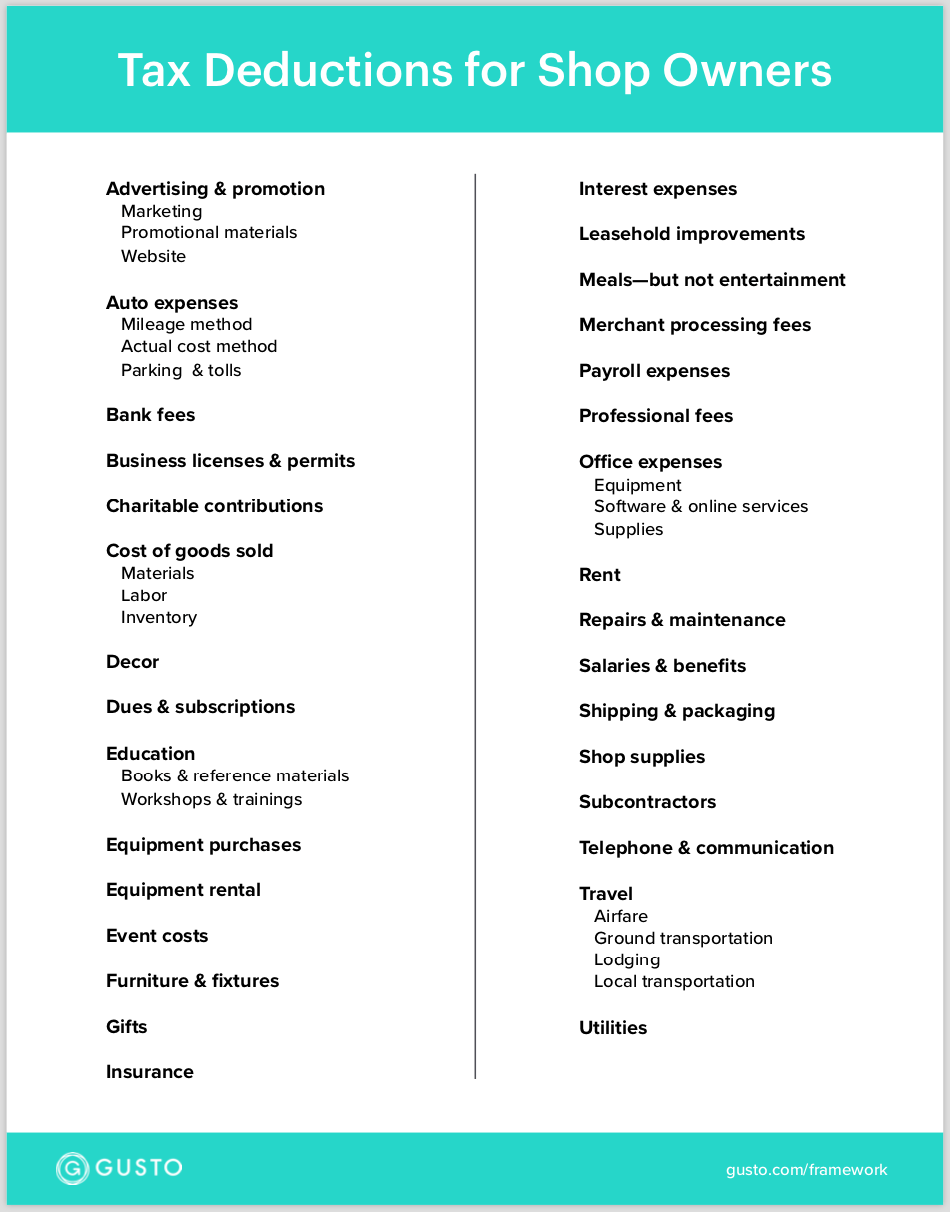

Personal tax deductions for business owners Charitable contributions.

Business deductions 2019. State income tax as an itemized deduction. The unadjusted basis immediately after acquisition. Businesses with pass-through entities including S-corporations and LLCs.

Owning and caring for a small business can be as tough as it is expensive especially if you pay more in taxes than you actually owe. The 20 qualified business income deduction went into effect in 2018. It also includes up to 20 of qualified real estate investment trust dividends and.

This component of the deduction equals 20 percent of QBI from a domestic business operated as a sole proprietorship or through a. Excise and fuel taxes. Employer-paid payroll taxes.

The threshold you need to cross before you can start deducting those expenses is 75 of 50000 or 3750. The QBI deduction is up to 20 of QBI from a pass-through entity conducting a trade or business in the US. Your expenses are 1250 above the.

If your taxable income is over 157500315000 the deduction is phased-out. Sales tax on day-to-day items included in the cost of the items sales tax on larger assets will be added to the total. Garrett Gunderson a finance expert performed a small study on small business tax and found that a large number of business owners pay more in.

Add up all the miles you drove for your business and multiply by the IRSs standard deduction rate to figure out your deduction. Sole proprietorships LLCs and partnerships cannot deduct charitable contributions as a. December 21 2018 By john.

Theyre fully deductible up to 4 each as long as they bear your business name and you distribute a lot of them such as pens you might offer to anyone who signs a contract with you. You deduct no more than 25 of the cost of business gifts you give directly or indirectly to each person during your tax year. Answer If you give business gifts in the course of your trade or business you can deduct all or part of the costs subject to the following limitations.

Employers may deduct. Meals and Entertainment Expenses. The type of trade or business The amount of W-2 wages paid by the qualified trade or business and.

3 So for example if you drive 5000 miles for business purposes in 2019 youll be able to deduct 2900 off your taxes. Real estate taxes on business properties. As of 2019 the standard mileage rate is 58 cents per mile.

Specified service business owners get the full pass-through deduction if their taxable income is below 157500 filing as a single or 315000 married filing jointly. The deduction allows eligible taxpayers to deduct up to 20 percent of their qualified business income QBI plus 20 percent of qualified real estate investment trust REIT dividends and qualified publicly traded partnership PTP income. Child and dependent care expenses.