HOA policies cover your home only for the 10 specific types of loss listed in the policy including fire explosion vandalism and theft. Depending on the type of policy you have insurance companies may put clauses into your coverage that limit certain aspects of your home like the roof.

Homeowners insurance also called home insurance provides financial protection in the event that the homeowners house or its contents are damaged.

Home insurance definition. Liability insurance by definition ensures against injury or damage. Homeowners insurance provides policyholders with coverage against loss andor damage to their homes and possessions also referred to as insured property. Homeowners insurance helps you protect the things that matter most.

Standard homeowners insurance protections A standard homeowners insurance policy insures your homes structure house and your belongings in the event of. Homeowners insurance protects one of your most important investments your home in the event that it is damaged or destroyed by a covered peril. The assets your home liability insurance is designed to protect includes everything from your liquid assets such as your checking and savings accounts to your investments and retirement accounts your valuable personal property your home and any other properties such as.

Your policy also includes coverage for structures that arent attached to your home. Homeowners insurance is a combination of property insurance which protects homeowners from future damages to a home and liability insurance which protects homeowners from claims by third parties for accidents that happen in the home. The perils covered by an HO-7 may be different than those covered by a standard HO-2.

You may also hear it called home liability insurance or property liability insurance. This is a blanket term used to describe. Whats Not Covered by Standard Home Insurance Policy Forms.

It helps protect the personal property and physical structure of the home. Homeowners insurance is a form of property insurance that covers losses and damages to an individuals residence along with furnishings and other assets in the home. HO-3 homeowners insurance will also cover you for a variety of other expenses related to your home beyond your physical property.

Home insurance provides coverage for your building and your contents. Personal liability insurance covers the expenses or at least some of the expenses that you would otherwise incur if something happens to somebody else on your property. Home insurance also commonly called hazard insurance or homeowners insurance is a type of property insurance that covers a private residence.

To gain peace of mind with the right home insurance policy start your homeowners insurance quote today with Nationwide. The most important of these remaining features is personal liability coverage. A An HO-3 policy is insurance lingo for standard homeowners insurance but it also refers to a specific legal document that acts as an insurance contract.

The most basic type of homeowners insurance is called a basic form policy or HO-1. Personal Property Coverage sometimes referred to as Coverage or Contents Coverage is included in a standard home insurance policy and protects your personal items and household contents in the event they are stolen or destroyed by fire hurricane or other peril covered in your policy. Homeowners insurance provides you with financial protection in the event of a disaster or accident involving your home.

In Texas and other areas that use alternative policy types this coverage is called HOA. It is helpful to remember the words if something happens to somebody else. This type of policy form is a modified version of an HO-2.

If you have homeowners insurance you most likely have whats called an HO-3 policy the. Common coverages include personal liability loss of use and medical payments. One of the coverages is insurance for your roof.

It also provides protection in. This will cover you for expenses related to bodily injury or property damages for which you are legally liable. Having home insurance is an important way of protecting your home and belongings from the unknown and potentially avoid paying out of pocket for costly damages.

Homeowners Insurance Definition Danytarg Over Blog Com

Homeowners Insurance Definition Danytarg Over Blog Com

Home Insurance Insurance Definition Tips

Home Insurance Insurance Definition Tips

Homeowners Insurance Definition Coverage April Year

Homeowners Insurance Definition Coverage April Year

Https Www Michigan Gov Documents Cis Ofis 03homegd 74854 7 Pdf

Why Home Insurance Plays A Pivotal Role

Why Home Insurance Plays A Pivotal Role

/homedisaster_AP110828045473-5425d4abb8604e1699a29b76123baf65.jpg) Homeowners Insurance Definition

Homeowners Insurance Definition

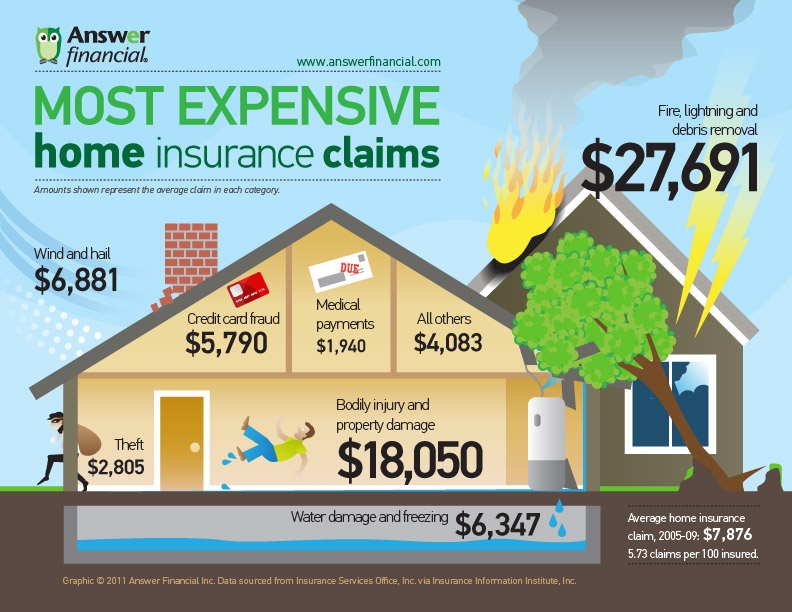

Most Expensive Home Insurance Claims Infographic Upstate S Choice Insurance

Most Expensive Home Insurance Claims Infographic Upstate S Choice Insurance

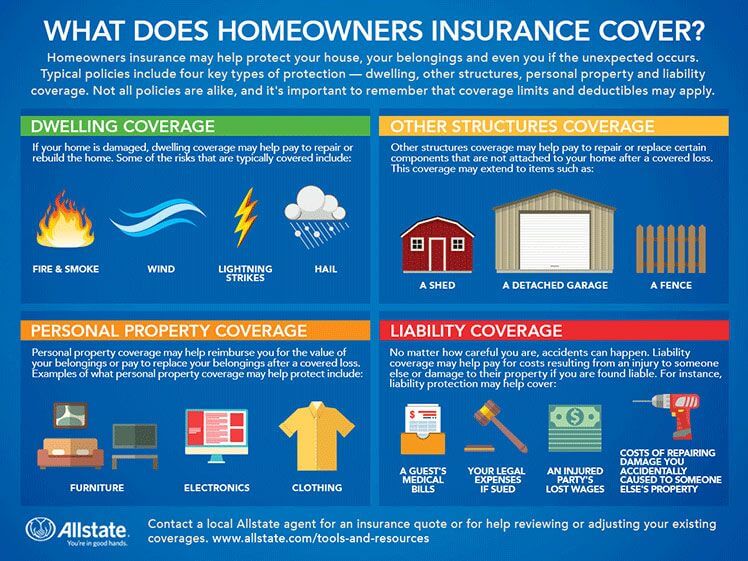

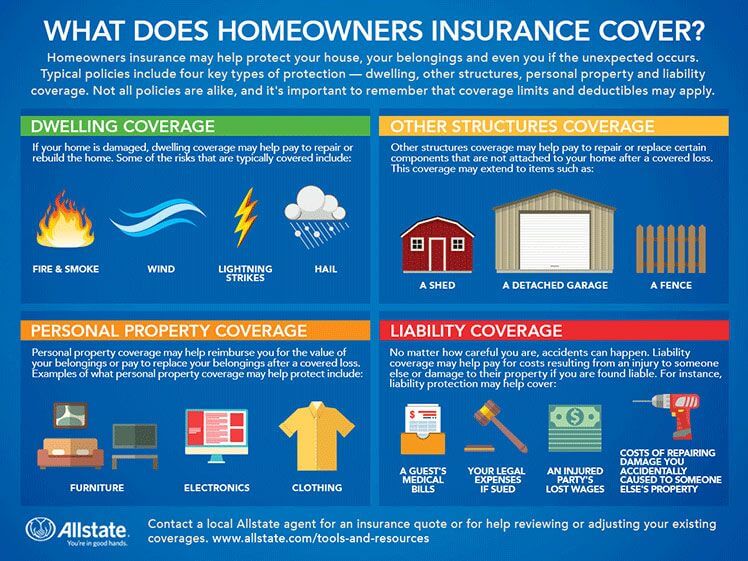

What Does Homeowners Insurance Cover Allstate

What Does Homeowners Insurance Cover Allstate

What Does Homeowners Insurance Cover Allstate

What Does Homeowners Insurance Cover Allstate

What Is Property Insurance What Does Property Insurance Mean Property Insurance Meaning Youtube

What Is Property Insurance What Does Property Insurance Mean Property Insurance Meaning Youtube

Compressed Study On Home Insurance

Compressed Study On Home Insurance

What Is Home Insurance And Types Of Home Insurance

What Is Home Insurance And Types Of Home Insurance

What Does Homeowners Insurance Cover Allstate

What Does Homeowners Insurance Cover Allstate

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.