For this purpose a direct. Highest marginal tax rate Corporate rate.

How Scandinavian Countries Pay For Their Government Spending

How Scandinavian Countries Pay For Their Government Spending

The Personal Income Tax Rate in Switzerland stands at 40 percent.

Switzerland tax rate vs us. A progressive tax system with 3 bands with tax rates from 20 to 45. The maximum corporate tax rate including all federal cantonal and communal taxes is between 119 and 216. Swiss paying agents who have the status of a Qualified Intermediary have under certain conditions to with-held taxes on dividends and interests received on behalf of the Switzerland-based US clients.

Personal allowance is reduced by 1. The United States as the source country subjects up to 85 percent of the benefits paid to US. Switzerland Edit United States Edit.

In Switzerland income taxes are levied on federal cantonal and municipal levels. Average Monthly Net Salary After Tax 571404 Fr. Just like in Switzerland taxes in the United States are levied at both state and federal levels which sees large differences in income tax paid in different parts of the country.

Taxable income CHF Tax on. The statutory Swiss WHT rate of 35 is levied but refunded provided that the respective earnings are declared as income for tax purposes. The federal Swiss corporate tax rate is a flat rate of 85 but additional cantonal and municipal rates can vary considerably.

Mortgage Interest Rate in Percentages Yearly for 20 Years Fixed-Rate. Citizens residing in Switzerland to taxation. Corporate Tax Rate in Switzerland averaged 1944 percent from 2003 until 2020 reaching an all time high of 25 percent in 2003 and a record low of 1777 percent in 2017.

The OECDs Taxing Wages 2017 report lists the average income tax rate paid by Americans with an income of US 87747 at 237. 11 Zeilen Countries with similar tax brackets include Czech Republic with a maximum tax bracket of. Benefits received by those individuals to taxation.

Contact Us. In most cantons the rate is proportional with a maximum rate of 65 in Bern whereas in Zurich it was 13 and in Geneva 1758-76 depending upon taxes as single or jointly. Furthermore in many cases the tax liability can be met by the notificationreporting procedure.

This holds also true for the so called Additional Withholding Tax USA. 626158 323451 Fr. Personal income tax rates Direct federal tax on income for 2020 I - Single taxpayers.

354445 -4339. Between Swiss group companies Swiss WHT of 35 is usually fully refundable. Switzerland levies a direct federal CIT at a flat rate of 85 on profit after tax.

However a range of allowances and deductions. On cantonal level tax rates varies heavily Obwalden adapted a 18 flat tax on all personal income following a cantonal referendum in 2007. Personal tax-free allowance provided of 12500 GBP.

Federal income tax rates range between 10 per cent and 40 per cent and depending what state you live in you can pay an additional state income tax ranging from 0 per cent no tax or at the highest end 133 per cent in California. Swiss Federal Tax Administration. 89 more than Switzerland Highest marginal tax rate Individual.

However wealthy individuals can pay a low lump-sum. Switzerland is an attractive destination for foreign business owners and investors thanks to its low tax rates. DTTs the actual taxable income in Switzerland may differ from the tax rate determining income.

The Corporate Tax Rate in Switzerland stands at 18 percent. This additional withholding tax amounts to 15 or 25 on dividends and 30 on interest which is excluded from national US withholding tax. So the amount you pay depends on which canton and even more specifically which municipality you reside in.

Switzerland as the residence country also subjects the US. Contrary to popular opinion Switzerland does not allow foreign individuals to live and bank in its borders tax-free. Furthermore dividend income from substantial participations may be taxed at a lower tax rate based on domestic federal and cantonal law.

Personal Income Tax Rate in Switzerland averaged 4009 percent from 2004 until 2020 reaching an all time high of 4040 percent in 2005 and a record low of 40 percent in 2008. 71 Zeilen Highest marginal tax rate Corporate rate. Accordingly CIT is deductible for tax purposes and reduces the applicable tax base ie.

Taxable income resulting in a direct federal CIT rate on profit before tax of approximately 783. This page provides - Switzerland Personal Income Tax Rate - actual values historical data forecast chart statistics economic calendar and news. Foreign tax credit relief can be applied only on the US.

52 more than Sweden Highest marginal tax rate Individual On income exceeding US 6641900 Ranked 26th.

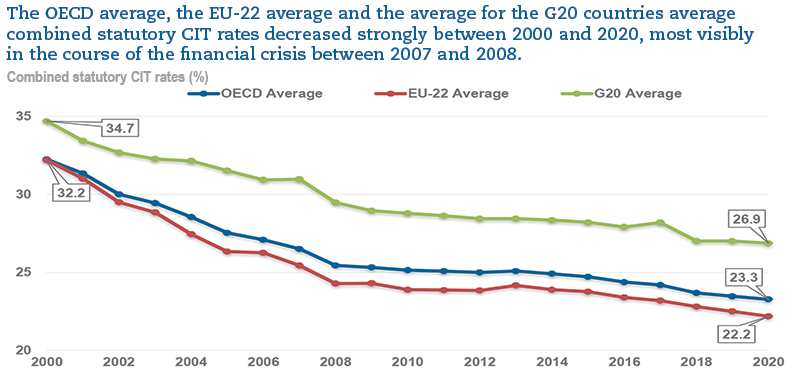

Updated Corporate Income Tax Rates In The Oecd Mercatus Center

Updated Corporate Income Tax Rates In The Oecd Mercatus Center

Corporate Tax Rates Around The World Tax Foundation

Corporate Tax Rates Around The World Tax Foundation

Switzerland Will Remain A Low Tax Centre For Big Firms The Economist

Switzerland Will Remain A Low Tax Centre For Big Firms The Economist

The U S Corporate Effective Tax Rate Myth And The Fact Tax Foundation

The U S Corporate Effective Tax Rate Myth And The Fact Tax Foundation

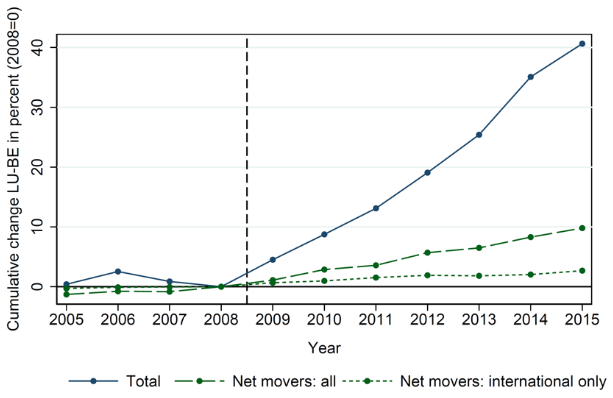

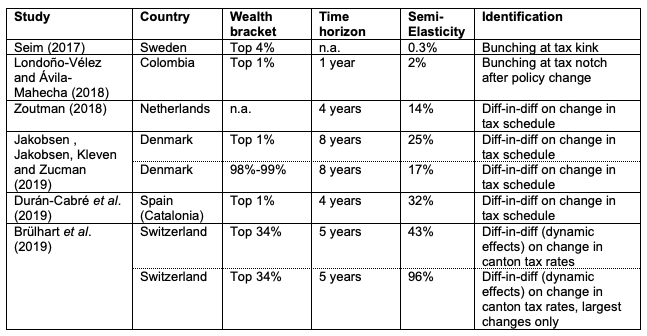

Wealth Taxation The Swiss Experience Vox Cepr Policy Portal

Wealth Taxation The Swiss Experience Vox Cepr Policy Portal

How High Are Taxes In Switzerland Quora

How High Are Taxes In Switzerland Quora

Wealth Taxation The Swiss Experience Vox Cepr Policy Portal

Wealth Taxation The Swiss Experience Vox Cepr Policy Portal

What Are The Consequences Of The New Us International Tax System Tax Policy Center

What Are The Consequences Of The New Us International Tax System Tax Policy Center

Is The U S The Highest Taxed Nation In The World Committee For A Responsible Federal Budget

Is The U S The Highest Taxed Nation In The World Committee For A Responsible Federal Budget

Swiss Corporate Tax Overhaul Faces Big Test Wsj

Swiss Corporate Tax Overhaul Faces Big Test Wsj

Yes The U S Corporate Tax Rate Is High National Review

Yes The U S Corporate Tax Rate Is High National Review

Taxation In Switzerland Wikipedia

Taxation In Switzerland Wikipedia

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.