Is near the very bottom well below the overall average of 34. And every country where we operate including paying 26 billion in corporate tax worldwide and reporting 34 billion in tax.

Who Pays Taxes In America In 2019 Itep

Who Pays Taxes In America In 2019 Itep

Since non-corporate small businesses are taxed through their owners personal tax returns how much they pay in taxes can get mixed up with the tax owed by the individual for all forms of income not just the income of the business.

How much does the us make in taxes. The new tax law lowered the statutory corporate tax rate to 21 but the companies in the report paid an average rate of 113. -The top one percent of households pay 394 percent of federal income taxes and 262 percent of total federal taxes. The top 5 paid around 58.

With a tax burden of 25 a measurement that includes income property and various other taxes the US. While income tax is the largest of the costs many others listed above are taken into account in the calculation. Overall the total amount of tax you will be paying is 311450 98750 2127.

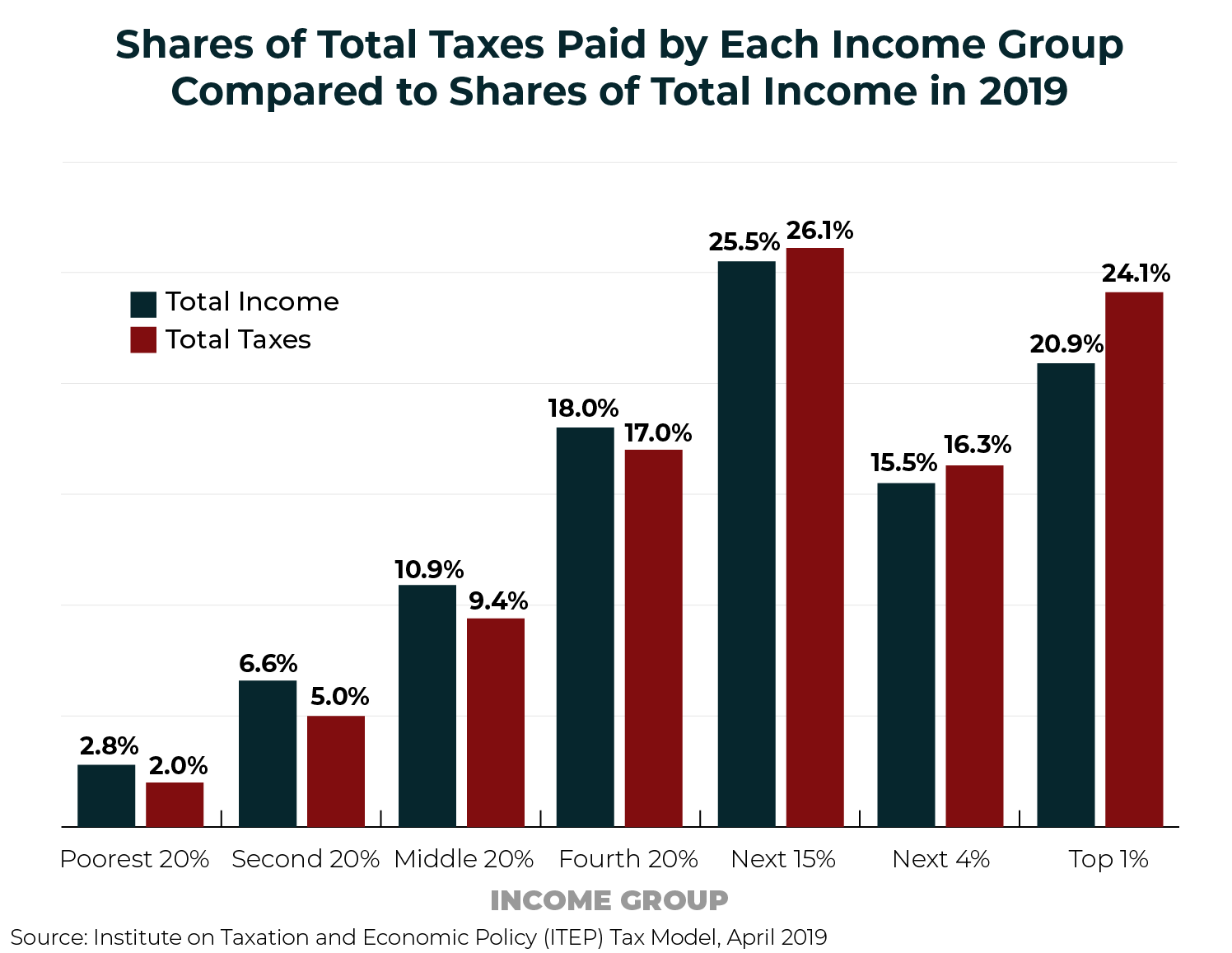

As illustrated in the graph the bottom fifth of Americans pay a lower effective total tax rate but they nonetheless pay a fifth of their income in taxes. This suggests that policy makers wishing to mitigate regressive features of the tax system should look elsewhere. General sales and gross receipts taxes.

This rate is the average of the tax for business or an individual taxpayer. While middle-class earners in the fourth quintile with income of 58000 to 89000 for singles pay a rate of 67. Amazon pays all the taxes we are required to pay in the US.

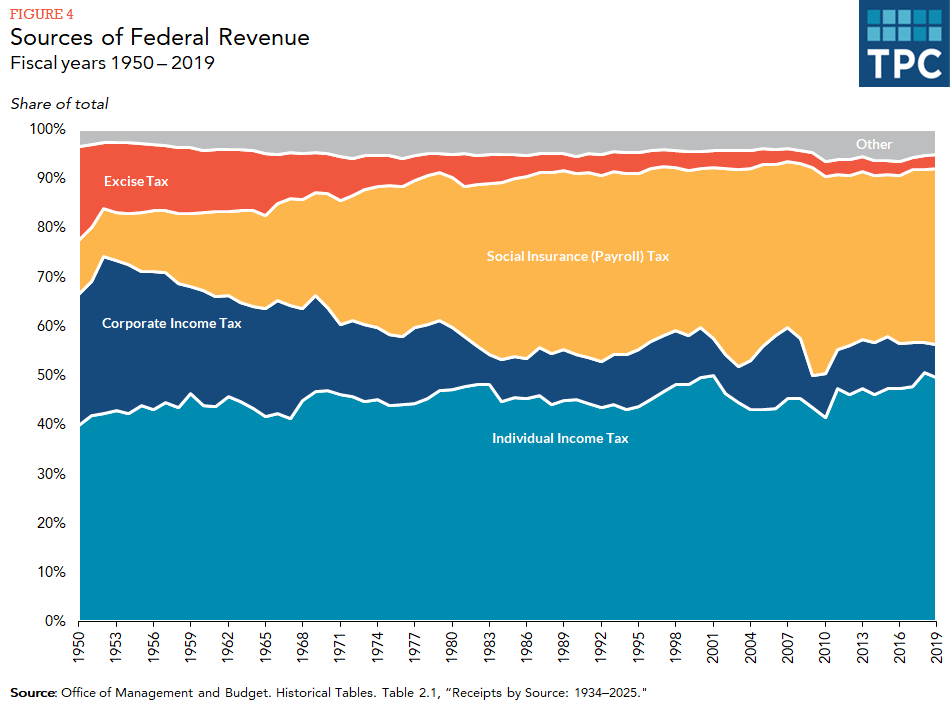

According to the Congressional Budget Office. Many states exempt certain goods like groceries or clothing from the sales tax for political reasons while excluding many consumer services such as dry-cleaning or barber services. Last year corporate income taxes contributed 444 billion to the US.

In 2018 the top 1 of US. - The top 20 percent of households pay 881 percent of federal income taxes and 695 percent of total federal taxes. The effective tax rate is.

Generally any profit you make on the sale of a stock is taxable at either 0 15 or 20 if you held the shares for more than a year or at your ordinary tax rate if you held the shares for less. Heres How Much Your State Makes From Taxes. In 2018 the average American family in the middle 20 of income earners paid 15748 in taxes to federal state and local governments.

This is much lower than the 13200 wed get by doing a straight 22 calculation on the total income. Those in the lowest income quintile earning up to 23000 for a single person actually get money back from the federal government. Earners paid roughly 37 of all federal income taxes.

The average single American contributed 298 of their earnings to three taxes in 2019income taxes Medicare and Social Security. For example FICA taxes are calculated as such. The average income tax rate for all Americans was 146 in 2017 according to the Tax Foundations method of calculation.

State and local sales and property taxes may be a more promising area for reform. In most states narrow sales tax bases make the sales tax less productive from a revenue standpoint than it could be. The Trump tax cut hasnt changed that.

This gives us a tax bill of 98750 3630 161150 6229. And the rich the top 1 of earners taking home 387000 or more pay 237. Since the 1950s purchases of consumer services have grown while purchases of consumer goods have declined as a share of total US.

Small businesses of all types pay an estimated average tax rate of 198 percent. It ranks below all the measured countries except Korea Chile and Mexico. Thats a fifth of the 22 trillion in total federal tax receipts and more than double the federal take from.

In fact by dividing 6229 by 60000 youll find that the effective tax rate in this example is actually only 104. The middle fifth of Americans pay about a fourth of their income in taxes while the top 1 percent pay about a third of their income in taxes. One of the simplest ways to think about Americans economic standard of living is to consider how much people earn in income pay in taxes and receive from the government in the form of government transfers.

Trump and other Republicans are right about one aspect of US. The 2017 Tax Law Made Our Tax System Less Progressive.